Governance of One REIT

One REIT has established various regulations, including rules for the Board of Directors and Regulations Governing Insider Trading, and currently holds Board of Directors meetings approximately once a month and ensures appropriate decision-making.

In addition, the Asset Management Company appropriately reports on asset management operations for One REIT to the Board of Directors and provides information necessary for the board to make decisions, ensuring that One REIT has a sufficient check-and-balance function over the Asset Management Company. Furthermore, by positioning thorough compliance as a fundamental management principle, the Asset Management Company strives to protect investors by ensuring the appropriateness of asset management and the soundness of operations.

Executive Director and Supervisory Directors

When electing director candidates, at least one executive director and two supervisory directors, who do not fall under the disqualification grounds stipulated in laws and regulations such as the Act on Investment Trusts and Investment Corporations (Article 98, Items 2, 4 and 5 of the Act, and Article 244 of the regulation for enforcement of the Act), are elected by resolution of a general meeting of unitholders. The executive director concurrently serves as the Chief Executive Officer of the asset management company. The supervisory directors are third parties who have no special interest in One REIT and are knowledgeable lawyers or certified public accountants.

The status of attendance of each board member at board of directors' meetings will be posted after the aggregation of data.

This table can be scrolled sideways.

| Title | Name | Board of directors attendance rate(Note) |

|---|---|---|

| Executive Director | Hirofumi Nabeyama (Note2) | 100.0% (13/13times) |

| Supervisory Director | Yoshiki Ohmori | 100.0% (13/13times) |

| Supervisory Director | Kazunori Furukawa | 100.0% (13/13times) |

- (Note1) The number of board of directors' meetings attended and attendance rate are from March 1, 2024 to February 28, 2025.

- (Note2) Hirofumi Nabeyama retired from the position of executive director on May 31, 2025, and Hidetoshi Kato was newly appointed as executive director on June 1, 2025. Furthermore, Hirofumi Nabeyama concurrently served as the representative director of MREIT during his tenure.

Policy on Director Ownership of Investment Units

In order to prevent insider trading (insider trading by corporate insiders, etc. and insider trading by parties connected to tender offerors, etc.), One REIT's Regulations Governing Insider Trading stipulate that One REIT’s executive directors and supervisory directors may not conduct activities such as buying and selling of One REIT’s investment units, etc. (except in cases falling under each item of Article 166, Paragraph 6, or Article 167, Paragraph 5, of the Financial Instruments and Exchange Act).

Management Compensation, Etc.

The management compensation, etc. paid by One REIT is as follows.

Executive Director and Supervisory Director Compensation

Director compensation is determined by the board of directors, with a maximum of 800,000 yen per month for executive directors and 600,000 yen for supervisory directors.

This table can be scrolled sideways.

| Title | Name | Total title compensation | |

|---|---|---|---|

| Period ended February 2025 (23rd period) |

Period ended August 2025 (24th period) |

||

| Executive director | Hirofumi Nabeyama | - | - |

| Hidetoshi Kato (Note) | - | - | |

| Supervisory directors | Yoshiki Ohmori | 1,938 thousand yen | 1,938 thousand yen |

| Kazunori Furukawa | 1,938 thousand yen | 1,938 thousand yen | |

- (Note) Hidetoshi Kato, Executive Officer owns three investment units (rounded down to the nearest whole unit) of One REIT as of August 31, 2025, by utilizing the cumulative investment unit investment program. The supervisory directors don't own any investment units of One REIT.

Accounting Auditor Compensation

Accounting auditor compensation is determined by the board of directors, with a maximum of 20 million yen per fiscal period subject to audit.

This table can be scrolled sideways.

| Position | Name | Total compensation | |

|---|---|---|---|

| Period ended February 2025 (23rd period) |

Period ended August 2025 (24th period) |

||

| Accounting auditor | Ernst & Young ShinNihon LLC | 12,300 thousand yen (Note1) | 15,300 thousand yen (Note2) |

- (Note1) The compensation includes compensation for auditing English financial statements.

- (Note2) The compensation includes compensation for auditing English financial statements and preparing comfort letters related to the issuance of investment corporation bonds.

Asset Management Company Compensation

Compensation paid to the Asset Management Company consists of the Management Fee 1, Management Fee 2, Management Fee 3, Acquisition Fee, Transfer Fee and Merger Fee. The calculation formula for each of these fees is as follows.

This table can be scrolled sideways.

| Calculation method | ||

|---|---|---|

| Management Fees | Management Fee 1 | Total assets×0.3%×(Number of months in the fiscal period/12) |

| Management Fee 2 | NOI(Note 1)×2.5% | |

| Management Fee 3 | EPU(Note 2)×2,000 | |

| Acquisition Fee | Acquisition price×1.0% (Transactions with interested parties: Acquisition price×0.5%) |

|

| Transfer Fee | Transfer price×1.0% (Transactions with interested parties: Transfer price×0.5%) |

|

| Merger Fee | Appraisal value of real-estate-related assets, etc. (on effective date of merger)×1.0% | |

- (Note 1) NOI is the amount arrived at after deducting property-related operating expenses (excluding depreciation and loss on retirement of noncurrent assets) from the sum total of property-related operating revenue, silent partnership dividends and revenues from Real Estate-Related loans and other assets for each operating period.

- (Note 2) EPU is the amount arrived at after dividing net income before income taxes (the amount before deducting Management Fee 3 and non-deductible consumption tax for Management Fee 3 and after adding amortization of goodwill and deducting gain on negative goodwill) for each operating period (if there is loss carried forward, the amount after covering the amount) by the total number of investment units issued and outstanding as of the period’s settlement for the relevant operating period.

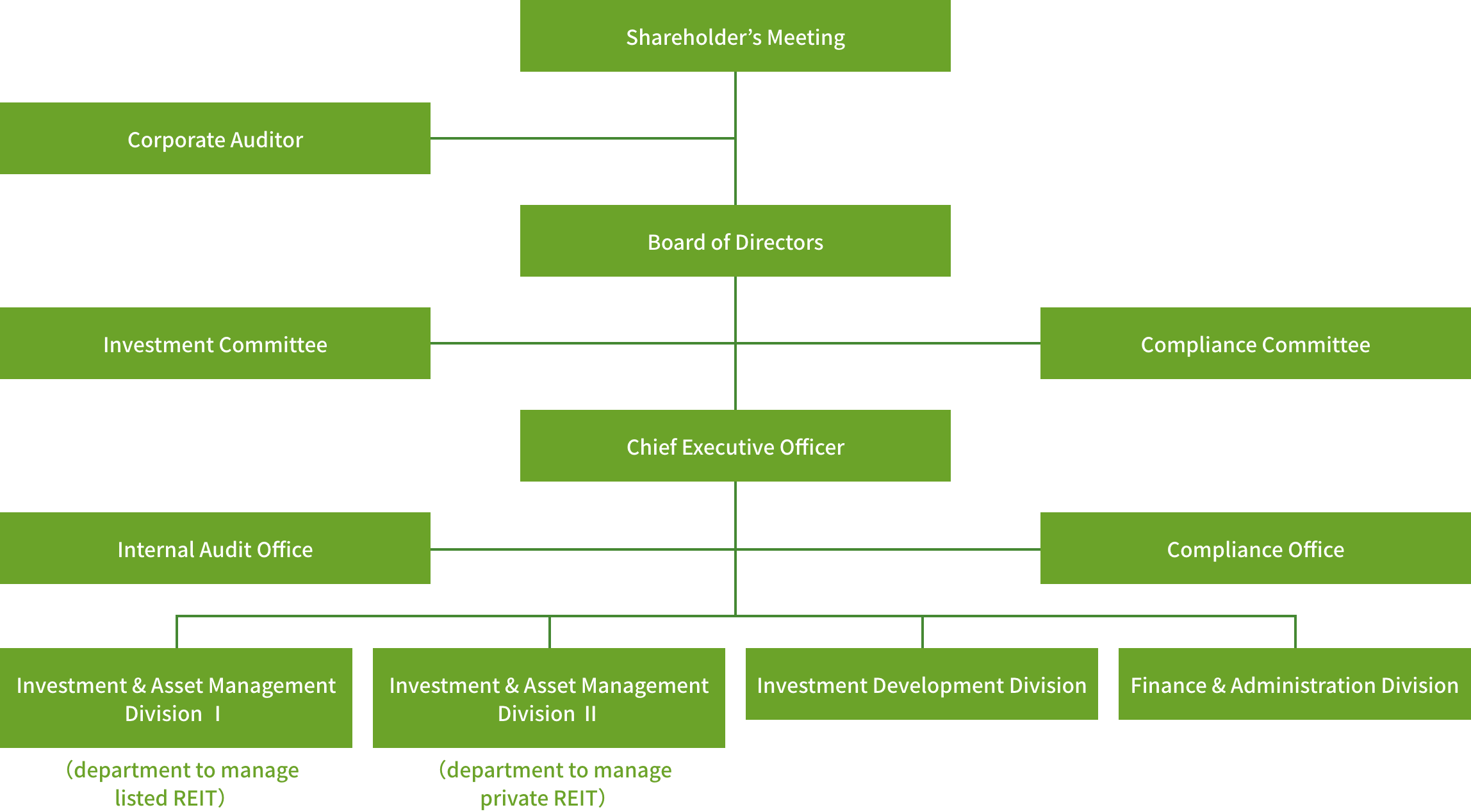

Management Structure and Governance of Asset Management Company

The Asset Management Company manages One REIT's assets in accordance with their asset management agreement. Understanding the importance of this asset management as managing the REIT’s unitholders' funds, it has established, in order to build an appropriate management structure, various regulations to confirm compliance with laws and regulations and execute fair and appropriate business operations under the following management structure when taking the decision-making procedures for investment management.

Organization

Overview of Each Body

This table can be scrolled sideways.

| Name | Overview | |

|---|---|---|

| Board of Directors | A body that supervises the execution of directors' duties, appoints and dismisses the representative director, and makes decisions about the execution of operations by the Asset Management Company, which determines key matters for the Asset Management Company | |

| Members | Chair: Chief Executive Officer Members: All directors and auditors *Auditors do not have voting rights. |

|

| Frequency | Convened by the chair at least once every three months. Other extraordinary meetings may be held as necessary. |

|

| Investment Committee | A collegial body that deliberates on the specifics of the investment policy stipulated in the Articles of Incorporation, policies on fundraising and distributions, acquisition and disposal of assets under management, and asset management policy, with authority delegated from the board of directors | |

| Members | Chair: Chief Executive Officer Members: All directors, heads of Investment & Asset Management Divisions I and II, head of Finance & Administration Division, Compliance Officer and outside directors Note: The head of Investment & Asset Management Division I (including cases where this individual concurrently serves as a board director) does not constitute a member of the Investment Committee for agenda items concerning One Private REIT, Inc., which is an open-ended non-listed private REIT, and the head of Investment & Asset Management Division II (including cases where this individual concurrently serves as a board director) does not constitute a member of the Investment Committee for agenda items concerning One REIT, Inc. In addition, the Compliance Officer does not have voting rights. |

|

| Frequency | Convened by the chair once a month in principle. Other meetings may be held as necessary. |

|

| Compliance Committee | A collegial body to deliberate on important compliance-related matters | |

| Members | Chair: Compliance Officer Members: Chief Executive Officer, head of Finance & Administration Division, outside committee members and additional persons appointed as necessary by the board of directors |

|

| Frequency | Convened by the chair once a month in principle. Other meetings may be held as necessary. |

|

Performance

The attendance rate of board members at board of directors' meetings will be posted after the aggregation of data.

Board of directors' meetings attendance rate: 97.2% (FY2024)

For details on the Asset Management Company's structure and governance, please see Chapter I: Fund Information, Part 1: Fund Status, 1. REIT Status, (4) REIT Organization, ② REIT Management Structure in the most recent securities report.

Establishment of System to Prevent Conflicts of Interest

Upon performing its asset management duties for One REIT, the Asset Management Company has established a system to appropriately manage conflicts of interest by identifying potential conflicts of interest with the REIT and establishing a basic policy for specific actions to be taken.

Conflict-of-Interest Transactions

Actions that may cause conflicts of interest with One REIT while managing its assets include transactions with parties with interests in the REIT and the Asset Management Company when the Asset Management Company manages assets for the REIT. Therefore, it has established interested party transaction rules and specifically categorized certain transactions with the potential for such conflicts of interest as "transactions with interested parties."

Management Policy for Transactions with Interested Parties

In managing One REIT's assets, the Asset Management Company will not only ensure that there are no legal issues with transactions with parties interested in the REIT and the Asset Management Company, but also that itself, as the trustee of the REIT's asset management, fulfills its responsibilities such as duty of care and duty of loyalty in these transactions. In addition, it will manage conflicts of interest by complying with the interested party transaction rules.

- (1) Parties with interests in the Asset Management Company

In its interested party transaction rules, the Asset Management Company has defined interested parties under its self-imposed rules more broadly than the scope of "interested parties, etc." in Article 201, Paragraph 1 of the Investment Trusts Act. - (2) Method of managing conflicts of interest

When conducting interested party transactions, the Asset Management Company will make decisions using strict internal procedures in accordance with its interested party transaction rules. - (3) Continuous improvement

The Asset Management Company will strive to continuously improve its management of conflicts of interest, including by reviewing its interested party transaction rules.

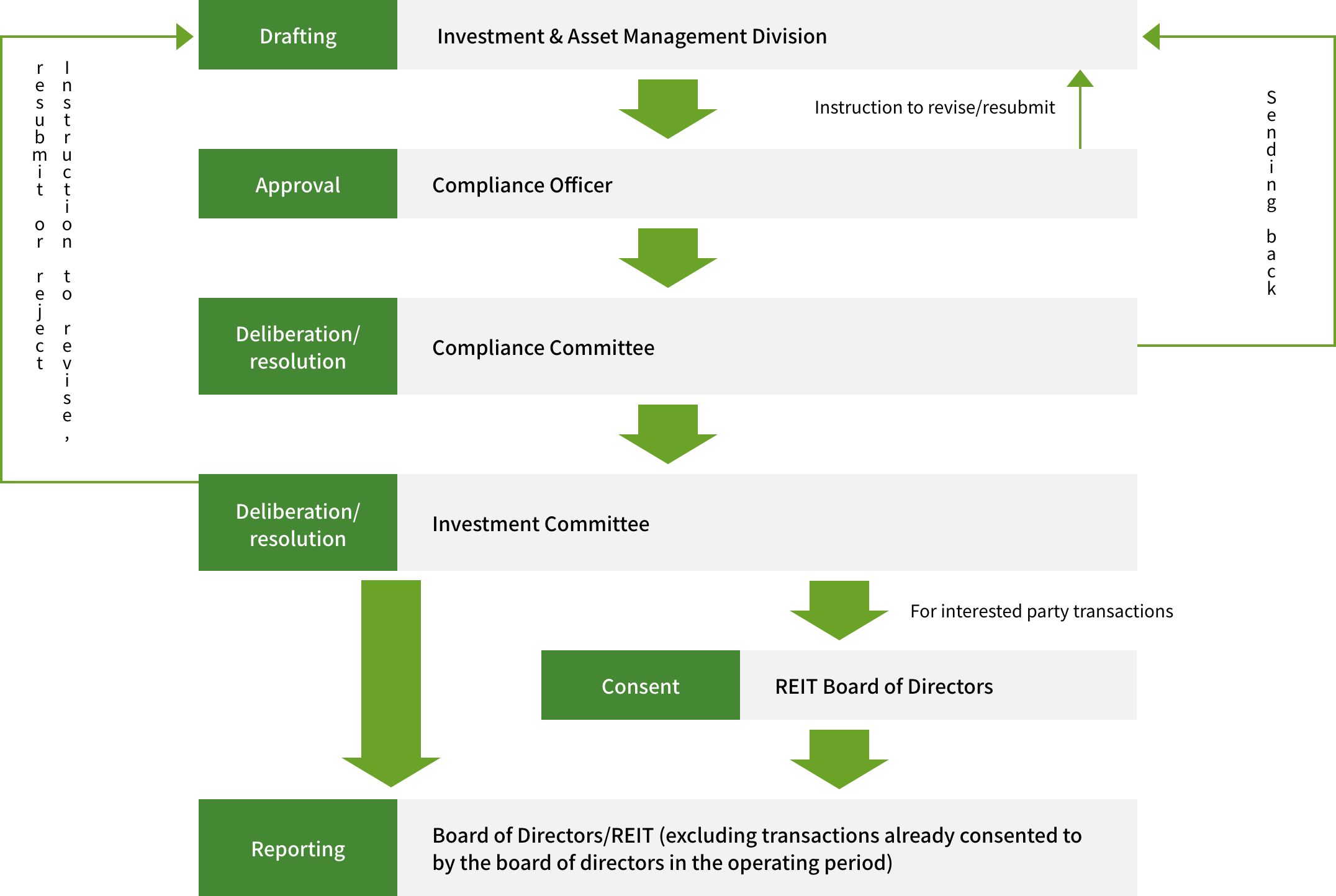

Internal Organization for Acquisition and Transfer of Assets Under Management

In addition to handling assets for One REIT, the Asset Management Company is also entrusted with asset management by One Private REIT, Inc. ("One Private REIT"), which is an open-ended non-listed private REIT. While One REIT mainly focuses on office buildings as its investment targets, One Private REIT mainly focuses on accommodation facilities, especially residential properties, as its investment targets. Accordingly, there is fundamentally no overlap between the main investment targets of One REIT and One Private REIT, and it is assumed that they will not be competing for acquisition opportunities. However, in the case of mixed-use assets, it is possible that competition for acquisition opportunities could arise between One REIT and One Private REIT. For the purpose of avoiding competition for opportunities to acquire properties, the Asset Management Company has formulated standards for preventing competition to acquire properties, which stipulate that in the case of a mixed-use property corresponding to an office building targeted for investment by One REIT, One REIT will obtain right of first consideration, while in the case of real estate where the majority of the leasable area is floor area for residential use or assets backed by such real estate, One Private REIT will obtain right of first consideration.

The Asset Management Company decides on proposed asset acquisition or transfer after drafting by the Investment & Asset Management Division I, approval by the compliance officer and resolutions by the Compliance Committee and Investment Committee. However, if this constitutes an interested party transaction, it must also obtain the consent of One REIT's board of directors. In addition, resolutions at Investment Committee meetings require the attendance of at least two-thirds of the members with voting rights (outside members and the compliance officer must also attend) and the approval of at least two-thirds of those in attendance with voting rights (however, for interested party transactions, this includes approval by the outside members). Resolutions at Compliance Committee meetings require the attendance of at least two-thirds of the members (outside members must also attend) and the approval of at least two-thirds of the members in attendance, including approval by the outside members. In addition, One REIT has established a structure to ensure it can acquire assets at appropriate prices and conditions to protect the interests of unitholders, including measures to prevent conflicts of interest in interested party transactions.

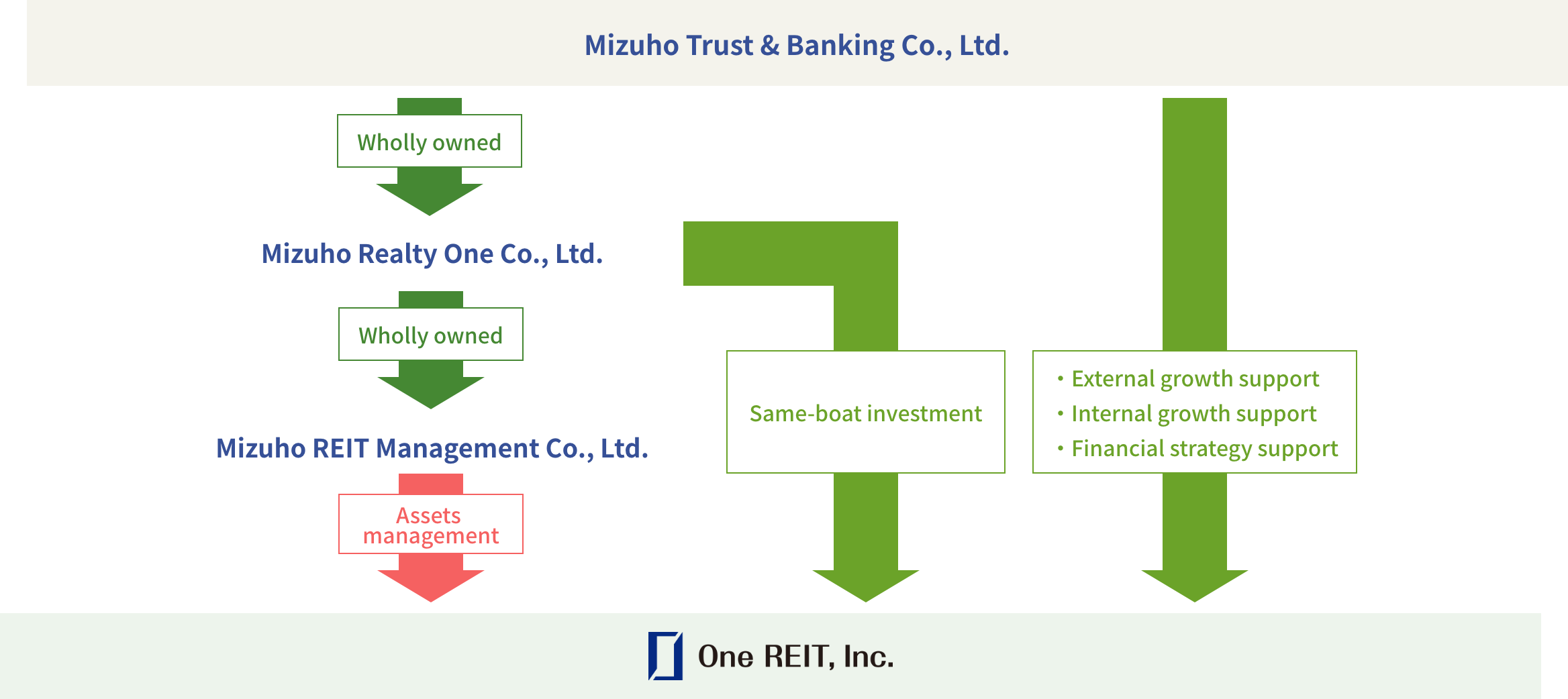

Same-Boat Investment

With the aim of sharing One REIT’s profits with its unitholders and sponsors (Mizuho Trust & Banking Co., Ltd. and Mizuho Realty One Co., Ltd., a wholly owned subsidiary of Mizuho Trust & Banking Co., Ltd.), the sponsors have shown their commitment to One REIT’s growth and are performing same-boat investment for the purpose of offering effective support for One REIT.

<Relationship between the Asset Management Company and the Sponsor>

Introduction of Cumulative Investment Unit Investment Program

A cumulative investment unit investment program has been introduced with the aim of further enhancing MONE Group executives’ and employees’ focus on improving One REIT’s performance and achieving continuous growth to increase unitholder value over the medium to long term.