Response to Climate Change

As indicated in the Paris Agreement (2015) and elsewhere, climate change is a scientific fact and is recognized as a material issue that will cause dramatic changes in the natural environment and social structure and have a significant impact on the overall management and business of One REIT and the Asset Management Company.

Based on the recognition that climate change is a global issue, One REIT aims to realize a decarbonized society and build a strong, climate change-resilient business foundation by managing and reducing energy consumption, greenhouse gas emissions, water consumption and waste volume, and enhancing severe disaster resiliency.

Support for TCFD (Task Force on Climate-related Financial Disclosures) Recommendations

In April 2022, Mizuho Realty One Co., Ltd. (MONE), which is the Asset Management Company's parent company announced its support for the TCFD recommendations and joined the TCFD Consortium, an organization of Japanese companies that have endorsed them.

One REIT and the Asset Management Company also recognize the importance of disclosing information on climate-related risks and opportunities, and are committed to addressing this and promoting further disclosure.

The TCFD published its final report in June 2017, recommending that companies disclose the following items on climate change-related risks and opportunities. (In October 2023, the TCFD was dissolved, and the International Sustainability Standards Board (ISSB), established under the IFRS Foundation, inherited the discussions of the TCFD.)

Disclosure Items Recommended by TCFD

This table can be scrolled sideways.

| Disclosure Item | Disclosure Details |

|---|---|

| Governance | Disclose the organization's governance around climate-related risks and opportunities. |

| Strategy | Disclose the actual and potential impacts that climate-related risks and opportunities will have on the organization’s businesses, strategy, and financial planning. |

| Risk management | Disclose the process which the organization uses to identify, assess, and manage climate-related risks. |

| Indicators and targets | Disclose the indicators and targets used to assess and manage relevant climate-related risks and opportunities. |

Basic Policy and Commitments

The Asset Management Company supports the international goals set forth in the Paris Agreement and will continuously work to reduce greenhouse gas emissions in order to contribute to the mitigation of climate change. In addition, in accordance with MONE, which endorses the TCFD recommendations, we will disclose climate-related information to our stakeholders while following the disclosure framework.

Governance

We have the following structure in place to address climate-related risks and opportunities.

(1) Board of Directors

The Board of Directors makes decisions on the formulation of mid- to long-term or annual plans for sustainability in the Asset Management Company's corporate operations and on other important sustainability matters.

(2) Investment Committee

The Investment Committee makes decisions on important sustainability matters for One REIT.

(3) Sustainability Promotion Council

The Sustainability Promotion Council is an advisory body to the Chief Executive Officer and discusses matters related to the Asset Management Company's corporate operations and the setting and monitoring of targets for sustainability initiatives of the REITs designated by the Chief Executive Officer.

(4) Sustainability Promotion Officer

The Sustainability Promotion Officer is the Chief Executive Officer, who oversees the sustainability initiatives of the Asset Management Company and its REIT.

(5) MONE Sustainability Committee

An advisory body to MONE's Board of Directors, MONE's Sustainability Committee deliberates on the MONE Group's sustainability policy, presents targets for the MONE Group to the Asset Management Company's Sustainability Promotion Officer, and monitors them. However, MONE is not involved in the Asset Management Company's decision-making on investment management matters for REITs which entrust their asset management to the Asset Management Company (regardless of the contract name or asset type). In addition, the MONE Group's Chief Climate Officer (MONE's President and Representative Director) can ask the Asset Management Company's Sustainability Promotion Officer to report to MONE's Sustainability Committee on the status of climate-related issues. (With respect to information concerning the REITs for which the Asset Management Company manages the assets, this is limited to information that the Asset Management Company deems may be provided without any problems, such as public information in the case of One REIT.)

Strategy

One REIT has analyzed scenarios in line with the TCFD recommendations in order to understand the risks and opportunities that climate change poses to the REIT and examine their impact.

Scenario Analysis Assumptions

(1) Time horizon

For the scenario analysis, we divided the timing in which financial impacts of climate-related risks and opportunities become more apparent into the following three time periods.

This table can be scrolled sideways.

| Period | Definition |

|---|---|

| Short term | 1 to 3 years later |

| Medium term | By 2035 |

| Long term | By 2050 |

(2) Information Sources Referenced

One REIT analyzed scenarios using future climate projections published by various international organizations, etc. as its main sources of information (shown below).

Note that climate-related risks can be broadly classified as "transition risks" or "physical risks," and may bring not only risks but also new business opportunities.

This table can be scrolled sideways.

| Climate-related risks | Main information sources referenced | |

|---|---|---|

| Transition risks | Business impacts resulting from social/economic transition to low/zero carbon |

|

| Physical risks | Business impacts resulting from ongoing climate change from previous patterns and phenomena |

|

(3) Scenarios based on the main information sources

Based on the Paris Agreement, our base cases for analysis were the 4°C scenario and the 1.5°C scenario, as summarized below.

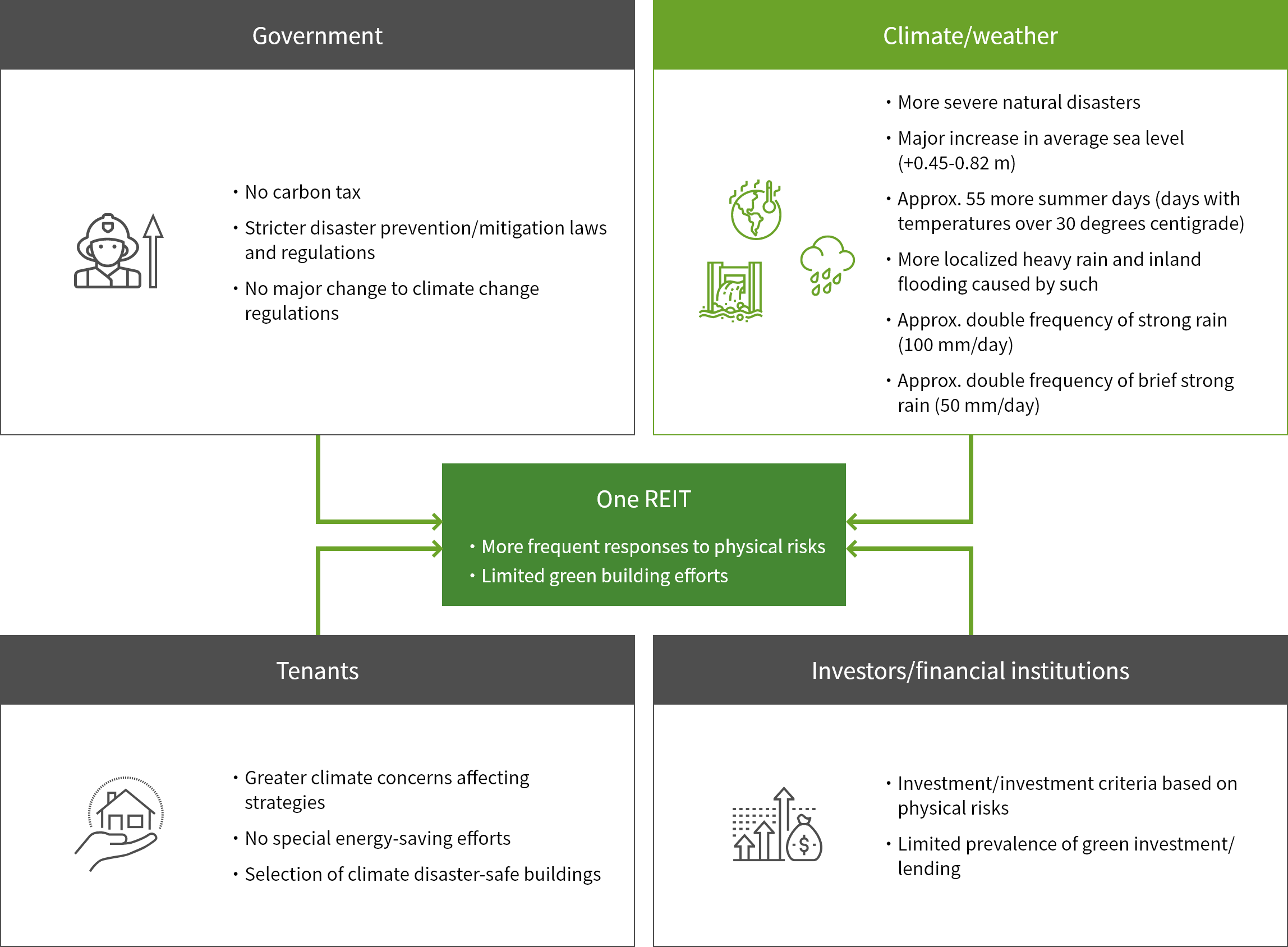

4°C Scenario (sources referenced: STEPS, RCP8.5)

A future in which climate change mitigation measures are insufficient and GHG emissions continue to rise, resulting in a large temperature increase. This scenario has high physical risk and low transition risk.

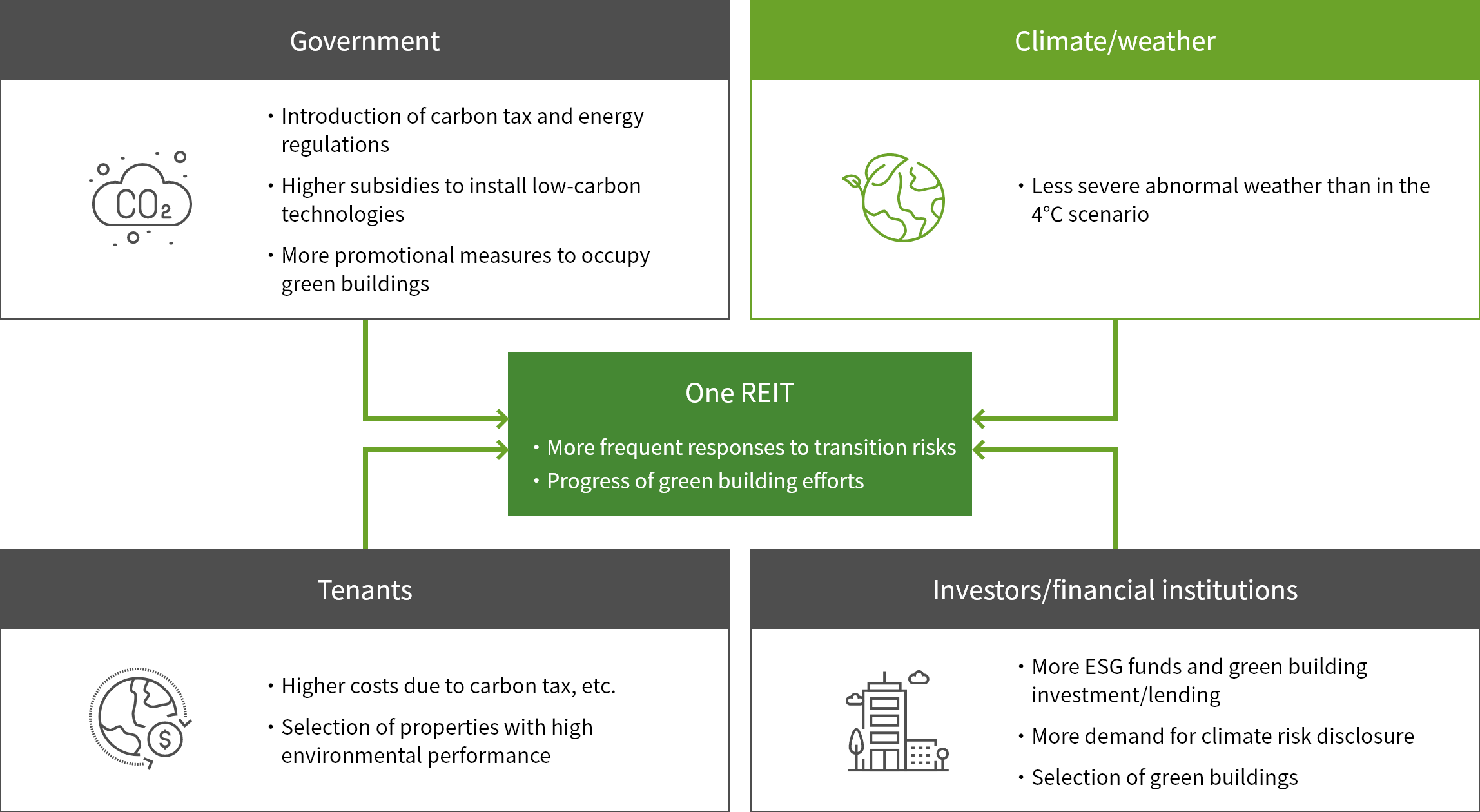

1.5°C Scenario (sources referenced: NEZ2050, RCP2.6)

A future in which zero-carbon social policies, emission controls and technology investment proceed more than in the present situation toward achieving the Paris Agreement targets, limiting temperature increase. This scenario has low physical risk and high transition risk.

Summary of Scenario Analysis

Based on the abovementioned assumptions, One REIT has examined climate-related risk and opportunity factors as well as financial implications and risk management/response measures that can be expected, as summarized below.

This table can be scrolled sideways.

Risk assessment timing: February 2026

This table can be scrolled sideways.

| Category | Factors | Type | Financial impact content | Financial impact | Risk management and countermeasures | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 4℃ scenario |

1.5℃ scenario |

||||||||||

| Short term |

medium term |

long term |

Short term |

medium term |

long term |

||||||

| Transition Risks and Opportunities | Policy and law |

Strengthening of carbon pricing | Risk |

|

Low | Low | Low | Low | Medium | High |

|

| Strengthening and expansion of disclosure and reporting obligations regarding GHG emissions, etc. | Risk |

|

Low | Low | Medium | Low | Medium | Medium |

|

||

| Strengthening and mandatory implementation of energy-saving standards and certification systems for buildings | Risk |

|

Low | Low | Low | Low | Medium | High |

|

||

| Opportunity |

|

Low | Low | Low | Low | Medium | Medium |

|

|||

| Expansion of subsidies | Opportunity |

|

Low | Low | Medium | Medium | Medium | Low |

|

||

| Technology |

Advancement and dissemination of renewable energy and energy-saving technologies | Risk |

|

Low | Low | Low | Medium | Medium | Medium |

|

|

| Opportunity |

|

Low | Low | Low | Low | Medium | Medium |

|

|||

| Market/reputation |

Increase in utilities costs (including external procurement of renewable energy) | Risk |

|

Low | Medium | High | Low | Low | Low |

|

|

| Changes in tenant demand and real estate transaction demand | Risk |

|

Low | Low | Low | Low | Medium | High |

|

||

| Opportunity |

|

Low | Low | Low | Low | Medium | Medium | ||||

| Risk |

|

Low | Medium | High | Low | Low | Medium |

|

|||

| Changes in evaluation criteria by investors and lenders | Risk |

|

Low | Low | Low | Low | Medium | High |

|

||

| Opportunity |

|

Low | Low | Low | Low | Medium | Low | ||||

| Physical Risks and Opportunities | Acute |

Increase in water damage, landslides, and wind damage caused by intensification of typhoons and heavy rainfall | Risk |

|

Low | Medium | High | Low | Low | Medium |

|

| Chronic |

Flood damage to properties with low elevation due to rising sea levels | Risk |

|

Low | Medium | High | Low | Low | Medium |

|

|

| Increase in extreme heat days and greater heat stress due to rising average temperatures | Risk |

|

Low | Low | High | Low | Low | Medium |

|

||

Risk Management

The Asset Management Company's Sustainability Promotion Officer manages identified and assessed climate-related risks and opportunities and promotes resilience initiatives to reduce business risks and realize value creation opportunities to ensure steady, sustainable earnings over the long term. The management process for climate-related risk and opportunity factors is as follows:

- The Sustainability Promotion Officer directs the Sustainability Promotion Council to consider the development of countermeasures for climate-related risks and opportunities that are high-priority in business and financial plans.

- The Sustainability Promotion Council's proposed measures are deliberated on and approved by the institutions specified in the Basic Policy on Sustainability Initiatives based on their content, and are then implemented.

- The Sustainability Promotion Officer also instructs the Asset Management Company to consider climate-related risks that are important in business and financial plans for its regulations.

Indicators and Targets

The following indicators and targets are used in the process of managing climate-related risks and opportunities.

| 指標 | 目標 | |

|---|---|---|

| 1 | Reduction of greenhouse gas emissions |

|

| 2 | Reduction of Energy consumption |

|

| 3 | Percentage of renewable energy usage in owned properties |

|

| 4 | Percentage of green building certification acquisition |

|