Characteristics of One REIT

1Portfolio Building Policy

In accordance with the investment policy set out in One REIT’s Articles of Incorporation, One REIT invests in office buildings, hotels, residences, retail facilities and real estate for other uses without limiting the main use for the purpose of aiming to build a portfolio that seeks, more than ever, both the securement of stable income and growth over the medium to long term.

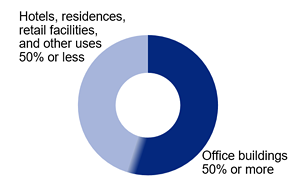

(1) Investment Ratio by Use

| ● | We will maintain the majority of investment in office buildings, where we have a proven track record and extensive knowledge (the investment policy will be "to not limit the main use" of assets, with the intention of allowing the proportion of investment in office buildings to temporarily drop below half). |

|---|---|

| ● | For the purpose of agile asset replacement, we set various investment targets for "hotels, residences, retail facilities, and other uses" so that we can flexibly consider acquisition opportunities in asset classes other than office buildings based on the market environment. |

(2) Investment Target Area

We set investment target areas according to asset use in consideration of the regional diversification of the portfolio, in Japan.

(3) Portfolio Building Policy by Use

Office buildings

| Location | Five major metropolitan areas centering on the Tokyo metropolitan area, regional ordinance-designated cities, etc. (Note 1) |

|---|---|

| Property type | Small and medium-sized office buildings (Note 2) (core investment target) and other office buildings |

Hotels

| Location |

|

||||||

|---|---|---|---|---|---|---|---|

| Property type |

|

Residences (Note 3)

| Location | Five major metropolitan areas centering on the Tokyo metropolitan area, regional ordinance-designated cities, etc. |

|---|---|

| Property type | General rental residences for which stable rental demand and rent levels can be expected |

Retail facilities

| Location | Five major metropolitan areas centering on the Tokyo metropolitan area, regional ordinance-designated cities, etc. |

|---|---|

| Property type | “Urban retail facilities”, which are retail facilities located in areas adjacent to terminal stations or bustling areas where retail facilities, administrative service facilities, etc. concentrate from a long time ago (central investment target) |

Real estate for other uses

| Location | - |

|---|---|

| Property type | Properties that are deemed to contribute to stable management of One REIT after comprehensively taking into consideration the regionality based on individual locational characteristics, versatility as income-generating real estate, etc. for assets that do not fall under the above uses |

| (Note 1) | Five major metropolitan areas refer to the Tokyo metropolitan area, Osaka area (Osaka City), Nagoya area (Nagoya City), Fukuoka area (Fukuoka City), Sapporo area (Sapporo City) and their suburbs. Regional ordinance-designated cities, etc. refer to ordinance-designated cities located outside the five major metropolitan areas and core regional cities which are prefectural capitals that are not ordinance-designated cities or their equivalents. The same applies hereinafter. |

|---|---|

| (Note 2) | Small and medium-sized office buildings refer to office buildings of which the total floor area is less than 33,000 m² (approximately 10,000 tsubos) and having certain building specifications that meet the needs of tenants. |

| (Note 3) | In principle, One Private REIT has the top priority and One REIT has the second highest priority for investment consideration at the Asset Management Company. |

2A Track Record and Extensive Knowledge of Investment Management in Small and Medium-sized Office Buildings

(1) Small and Medium-sized Office Buildings

Small and medium-sized office buildings, which are the focus of office building investment by One REIT, have a large stock in the market and are highly liquid in sales. In addition, tenants, mainly small and medium-sized enterprises, tend to be relatively replaceable, resulting in low volatility in rents and occupancy rates.

The Asset Management Company and its group companies (hereinafter referred to as “MONE Group”) have a long track record of solid investment management experience in small and medium-sized office buildings, and have abundant knowledge and expertise, having the ability to identify competitive properties and provide high-quality management capabilities. While there is an abundant stock of small and medium-sized office buildings on the market, many of them have reached a certain age, and there are many properties in the market that are not fully utilizing their competitiveness. Therefore, we believe that small and medium-sized office buildings are one investment target where we can pursue maximization of unitholder value by differentiation through the utilization of MONE Group's “ability to create added value”.

(2) Creation of Office Buildings Chosen by Tenants

We aim to form and promote brand strategies and realize the creation of optimum added value for tenants and unitholders.

3Utilization of Abundant and High-quality Property Information Obtained by Utilizing the Strength of the Sponsor

Mizuho Trust & Banking, the sponsor of One REIT, has high accessibility to information related to real estate owned and managed by clients. In addition, MONE Group collects unique information from real estate funds, financial institutions, construction companies/developers, companies, etc. in the real estate market with its unique network developed in private fund business that has been built up since the group founding in 2002.

4Construction of Stable Financial Base and Strict Internal Control and Risk Management System under Financial Sponsors

We build a stable financial base with a lender formation centering on Mizuho Trust & Banking, the sponsor, and Mizuho Bank, Ltd. In addition, we manage conflict-of-interest transactions, information management, etc. based on strict rules utilizing know-how at financial institutions.